Breach Assistance

Support

As a company’s digital presence expands — and as cyber criminals become more advanced — the cyber risks a business faces grow and become more sophisticated. Cyber insurance is critical to an organization’s overall cyber risk management strategy. It is intended to provide organizations with better protection against the financial risk posed by cyber security threats such as ransomware and data breaches.

Explore the research and data points below to learn more about why cyber insurance is an important and necessary value-add for organizations at a time of rising cyber security risk.

Support

The global cost of cyber crime is expected to increase to $23.84 trillion by 2027, up from $8.44 trillion in 2022. (1)

The average cost of a ransomware attack was $4.54 million in 2022 — not counting the cost of the ransom itself. (2)

There was a 68 percent increase in the overall number of compromised records between 2020 and 2021. (3)

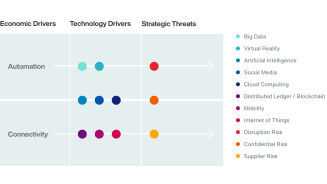

For the past decade, digital transformation initiatives have revolutionized how business is done. That process has accelerated as organizations adapt to rapidly evolving customer preferences and lead to benefits such as deeper customer engagement and significant efficiency gains.

However, these trends may have also expanded an organization’s vulnerability to cyber attacks. New applications, cloud-based infrastructure, the deployment of Internet-of-Things devices at the network edge and software-defined networking using the public internet are just some of the new surface areas for potential exploitation. As the universe of possible attack vectors grows, the likelihood is that someone will find a way to penetrate one or more of these system components.

The need for cyber insurance solutions has never been greater than it is today, and the factors for an organization to consider are a blend of economic, technological and strategic.

To understand potential threats, we help identify and quantify probable cyber losses. With this knowledge, organizations can make better decisions on risk appetite and appropriate levels of risk transfer using cyber insurance. Our holistic cyber risk management includes a multiphase solution for identifying, prioritizing and mitigating cyber exposure.

Aon’s Cyber Risk Analyzer simulates loss scenarios and articulates total cost of risk (TCOR), enabling clients to make data-driven decisions to optimize their cyber-insurance programs relative to their unhedged loss potential. Bringing in research from Aon's Cyber Risk Consulting team and decades of experience in cyber risk, we can better understand and forecast losses to build an informed view of risk.

The conversation about cyber insurance begins with a granular assessment of risk, based in part on the results of our Cyber Quotient (CyQu) Assessment which we carry out with each engagement. The CyQu Assessment enables organizations to avoid paper insurance applications by inputting their information into the CyQu platform. It also helps them understand short- and long-term security steps that they can take to help them secure more favorable insurance terms.

Product / Service

in total premium placed in 2022

E&O/cyber claims managed by Aon

recovered for Aon clients

new clients in 2022

(1) Cybercrime Expected To Skyrocket in Coming Years

(2) Cost of a data breach 2022 - A million-dollar race to detect and respond

Insurance products and services are offered by Aon Risk Insurance Services West, Inc., Aon Risk Services Central, Inc., Aon Risk Services Northeast, Inc., Aon Risk Services Southwest, Inc., and Aon Risk Services, Inc. of Florida, and their licensed affiliates.

The information contained herein and the statements expressed are of a general nature, not intended to address the circumstances of any particular individual or entity and provided for informational purposes only. The information does not replace the advice of legal counsel or a cyber insurance professional and should not be relied upon for any such purpose. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future.