Buyer-friendly market conditions continue, characterized by healthy competition, abundant capacity and incumbent

insurers seeking to retain renewals and potentially expand their participation.

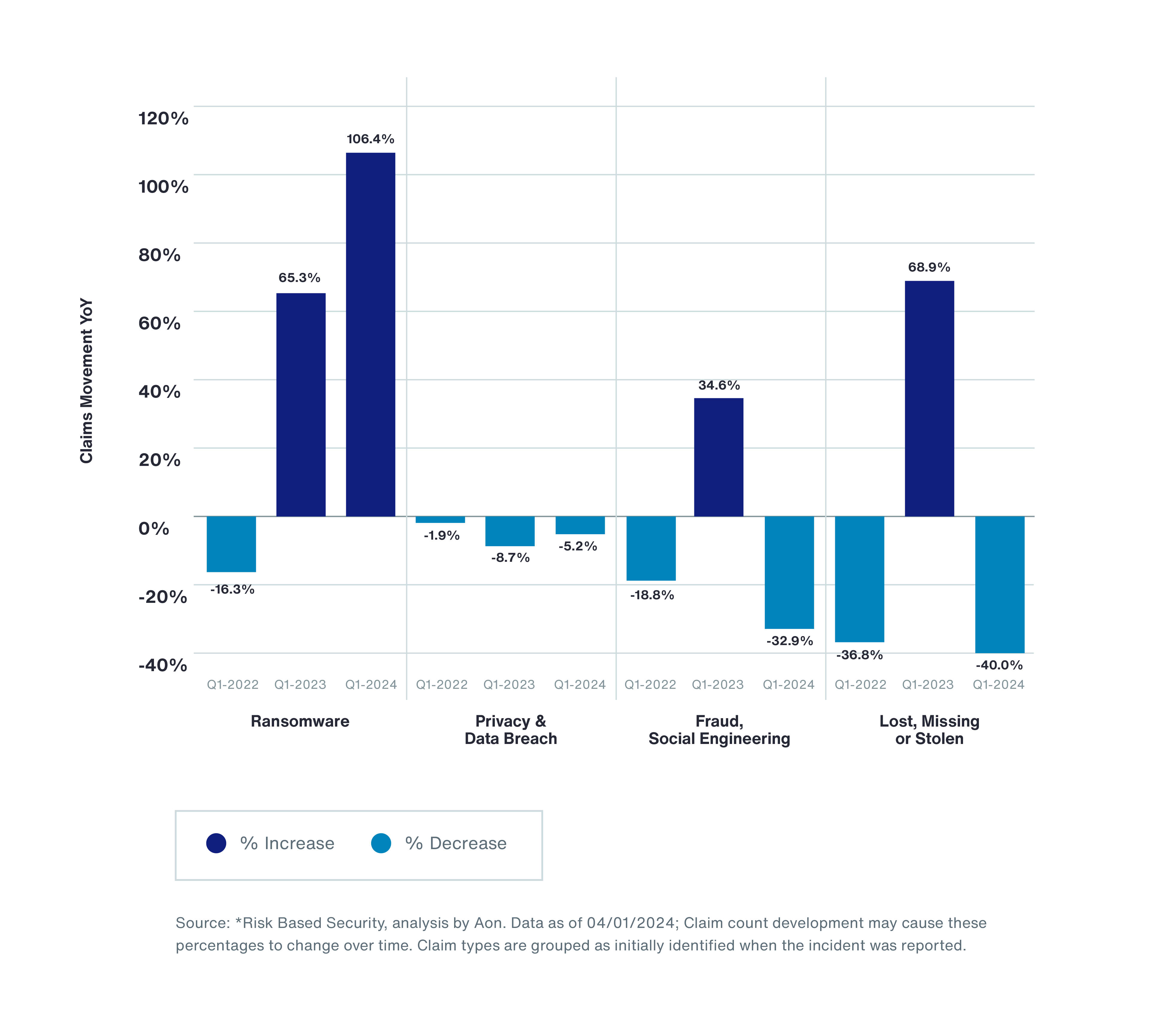

Risk differentiation is important to insurers, and they have priced it accordingly. Insurers continued to seek

underwriting data and best-in-class network security controls, but underwriters have shifted to also focus on

understanding and ensuring best-in-class privacy controls and policies.

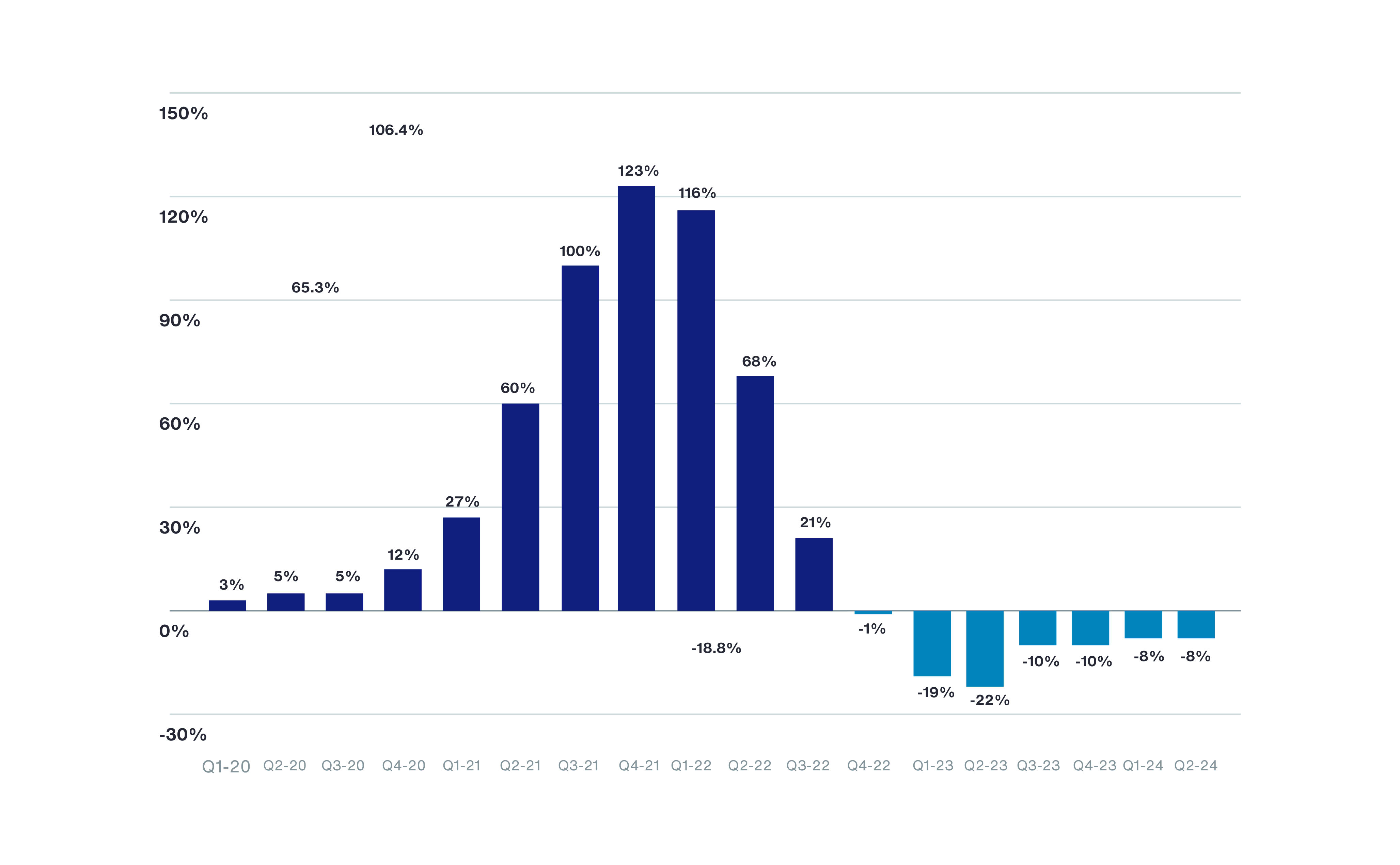

“Given the amount of competition in the U.S., especially with larger programs in the high excess space and middle

market segment, we are seeing pressure from underwriters who need to grow their books,” says Matt Chmel, chief

broking officer for Aon’s Cyber Solutions practice in North America. “That’s a dynamic that is pushing against some

of the current claim trends.”

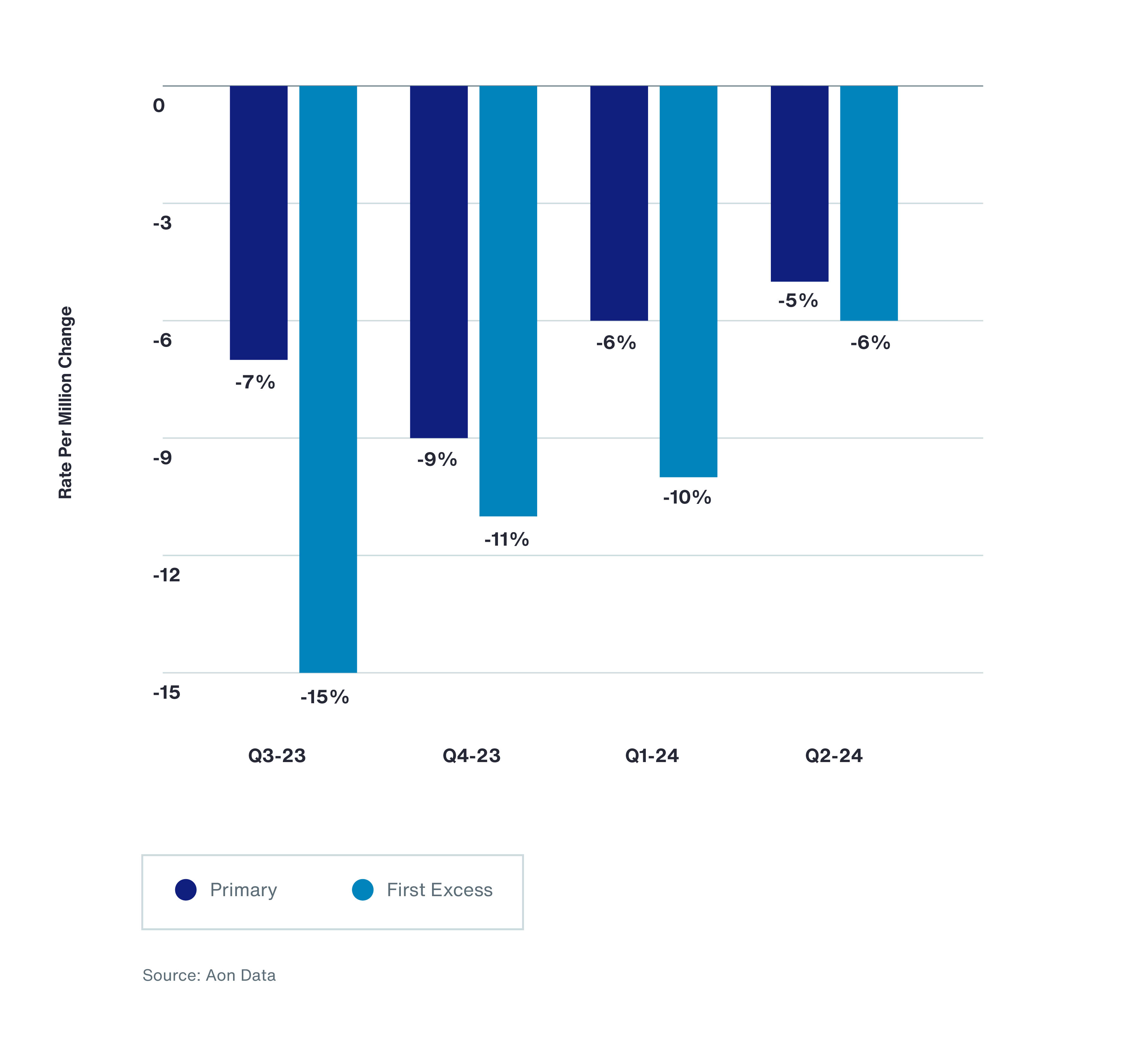

U.S. loss ratios, as reported to the National Association of Insurance Commissioners (NAIC), have decreased three

points to 42 percent in 2023, reflecting stronger controls and increased retentions. At the same time, cyber

premiums decreased less than one percent. The key is insurer profitability; insurer combined ratios on average stood

at a robust 73 percent, as reported to the NAIC.1

Canadian insurers are also in growth mode, creating a competitive market with decreased rates from 10 percent to as

high as 50 percent in some cases.

“There is ample capacity across most industry sectors. We can generate traction in multiple offers across most risks,

even for clients who don’t have best-in-class controls,” says Katie Andruchow, Aon’s cyber broking practice leader

in Canada. “This is not only generating premium movement, but also creativity around insurance coverages.”