When hurricanes Helene and Milton struck the Florida Gulf Coast 13 days apart, their combined insured loss estimates threatened to be among the worst in U.S. history, ultimately altering the U.S. commercial property insurance market.

Insured losses, however, were less than expected — estimated to fall between $34 billion and $54 billion, according to Aon’s Reinsurance estimates. The short-term prospect of a return to harder market conditions is unlikely, and the 2025 renewal environment is expected to remain stable.

“As a result of rate increases and retention resets in the reinsurance market in 2023, ceded losses to reinsurers from Milton are expected to produce industry loss ratios near their planned levels,” says Tracy Hatlestad, executive managing director and global property segment leader with Aon’s Reinsurance Solutions.

Well-capitalized primary and reinsurance markets are positioned to absorb losses from both events:

- Total direct industry policyholder surplus stood at $1.1 trillion, as of June 30, 2024, according to Aon analysis of S&P Global Market Intelligence data. Aon expects the primary property market to continue to moderate for the balance of 2024 and into 2025.

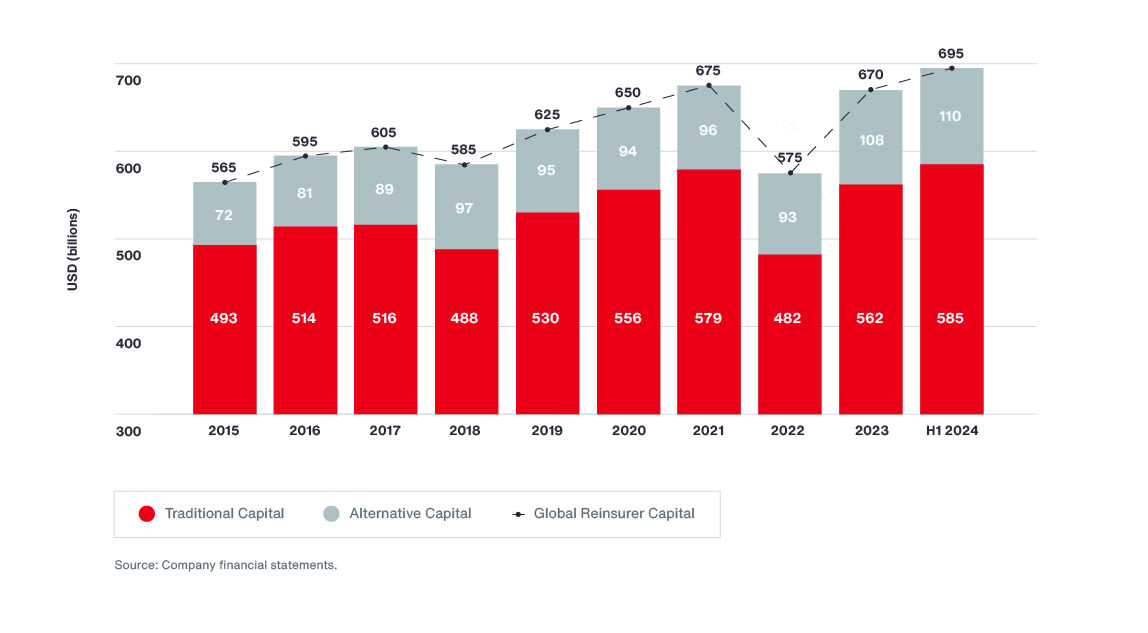

- Peak global reinsurer capital levels of $695 billion reached in H1 2024. As a result, reinsurance losses from both events will be manageable. Further, metrics point to a stable reinsurance market into 2025.

“Clients with heavy Florida and Gulf Coast exposure concentrations may be slightly more challenged, however, we expect the moderating property market to continue, especially for well-performing risks,” says Vincent Flood, head of U.S. Property with Aon. “We believe markets will continue to be aggressive through the remainder of 2024 and into 2025.”

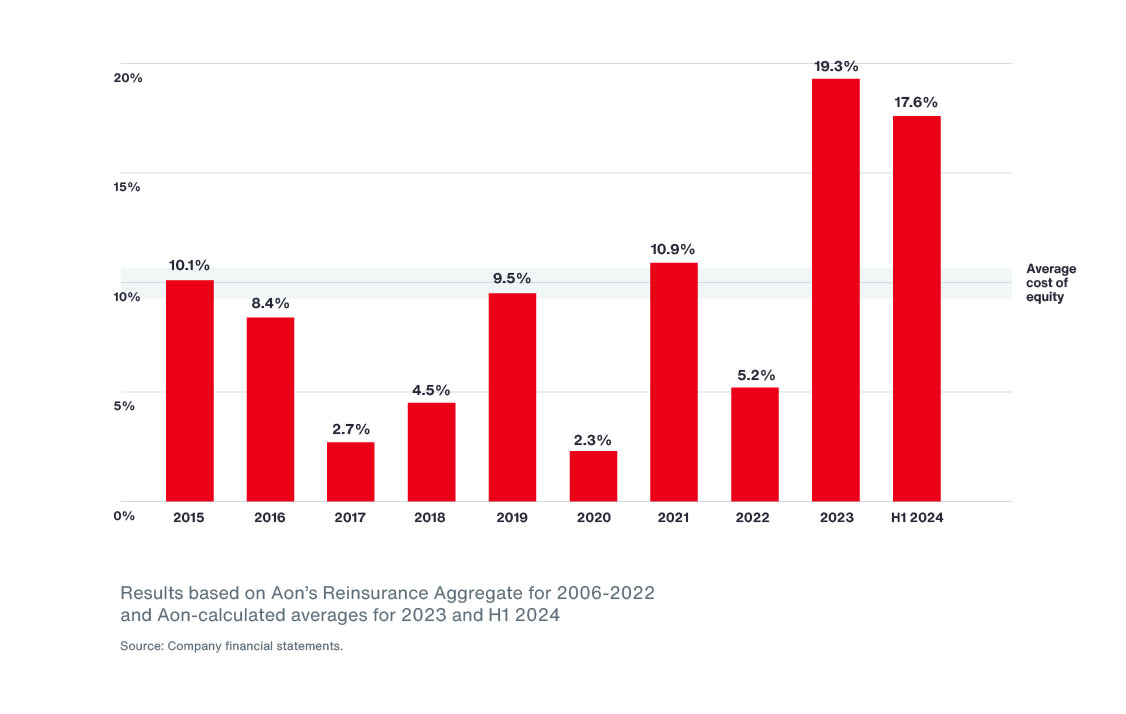

Reinsurers are amid 18 months of strong performance, with a return on equity nearly double the average cost of equity in 2023 and H1 2024. That strength is typically passed to the primary markets in lower reinsurance treaty premiums.

Global Reinsurance Return on Equity