Article

2023 has been shaped so far by geopolitical turbulence and climate-related events, but also economic resilience in the face of persistent inflation. Humanitarian concerns are at the forefront of global priorities for society at large, but lingering concerns about financial solvency following failures in the banking sector continue for many business leaders. Beyond these foundational concerns, cyber/ransomware threats, the shifting labor market, and technological advances such as Artificial Intelligence (AI) are weighing on the minds of people from every corner of the world, including business leaders who are guiding their firms in these changing times. Indeed, the results of Aon’s recent Global Risk Management Survey of nearly 3,000 business leaders around the world pointed to cyber risk, business interruption, supply chain disruption and failure to attract or retain talent as some of their top concerns. While each of these risks poses unique challenges, their increasing inter-connectedness and severity calls for a further evolution of risk transfer approaches that leverage rapidly developing datasets and sophisticated modeling to identify a combination of traditional and innovative solutions that holistically meet each firm’s individual risk tolerances and objectives.

Aon’s global team of experts can help, whether you are navigating the traditional insurance market, seeking alternative capital solutions or need specialized support such as terrorism products or supply chain management advice. This quarter’s report describes some of the important developments in the Q3 insurance market and includes special features (on topics such as Generative AI and "Nuclear Verdicts") to help you navigate the complexities and challenges of today’s risk and insurance environment.

In summary, key Q3 insurance market trends include:

A complex macro environment shaped insurer confidence and strategies. Economic resilience, gradual improvements in global supply chains, and a global construction boom served to bolster insurer confidence, while geopolitical instability, persistent social and economic inflation, and climate-related concerns created uncertainty and conservatism. Use of data, analytics and modelling gained further momentum in informing insurer strategies and optimizing capital deployment.

While the Q3 insurance market continued to moderate as insurers sought to balance growth with profitability, divergent conditions continued for favored versus challenged risks.

Article

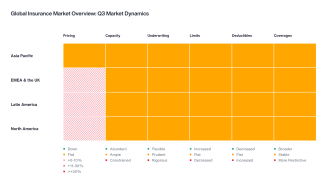

Expand the options below to read a summary of how the insurance market trended in Q3 2023 across pricing, capacity, underwriting, limits, deductibles and coverages.

Adverse claims trends pressured pricing upward across Auto and Casualty, while Cyber and Directors & Officers experienced a softening market as incumbent insurers sought to retain and grow their portfolios. Property pricing remained volatile due to concerns related to inflation, high reinsurance costs, climate change and Natural Catastrophe exposures. USA-exposed risk (on non-USA placements) remained challenged.

Capacity was sufficient across most products and risk types as established insurers expanded their appetite, and other insurers (re)entered markets targeted for growth. Capacity for Natural Catastrophe-exposed Property risks remained constrained – and expensive – driving greater use of alternative solutions including index-based products, self-insurance and captives.

As insurers focused on profitable growth, underwriting stringency gave way to flexibility, but discipline continued. Underwriters focused on individual risk profile, controls and performance. Risk quality and differentiation remained a top priority. Use of data and analytics to support decision-making continued to gain prevalence. Superior results were achieved through early engagement with insurers and robust submission details, including descriptions of valuation methodologies, risk control practices, improvements implemented, and lessons learned from past claims.

Most placements renewed with expiring limits and sub-limits; however, Property limits were pressured upward by economic inflation, which, together with social inflation and "nuclear verdicts", also impacted Auto and Casualty limits. Larger limits were available on Cyber and Directors & Officers placements as clients sought to restore limits reduced in recent years. Detailed descriptions of Property valuation methodologies were required, and valuation limitation clauses/margin clauses were mandated with greater frequency.

Expiring deductibles were achieved on most placements, although increases and minimum deductibles were required on some poor-performing risks and higher-risk sectors. Decreases were available on some well-performing classes and risks but were often declined by clients due to incommensurate additional premiums.

Coverage enhancements, supported by quality underwriting data, were available in areas targeted for growth as insurers continued to leverage coverage terms as a differentiator. Some exclusions (e.g., Communicable Disease, War and Territory restrictions) remained non-negotiable.

Expand the options below to read a summary of how the insurance market trended in Q3 2023 across key lines of business, including Automobile, Casualty/Liability, Cyber, Directors & Officers and Property.

A convergence of factors led to moderate-to-challenging market conditions. Costs continued to climb, driven by inflation, large verdicts and settlements, global supply chain disruptions, increasing accident frequency, labor shortages, and advanced automotive technologies; however, the availability of alternative solutions and healthy insurer appetite for well-performing risks served to dampen market impacts and price increases. The underwriting environment was disciplined; underwriters focused on portfolio sustainability and client risk management practices, especially for heavy risks. Innovative automotive technologies served to enhance underwriting approaches and product offerings.

Moderate market conditions, characterized by flat to modestly increased pricing, disciplined underwriting and focused but healthy appetite, continued across most of the portfolio, despite insurer concerns related to economic, social and claims inflation – including "nuclear verdicts", litigation funding, US Auto attachment points, large auto/heavy fleet exposures, biometric privacy, diacetyl, forever chemicals (PFAS), wildfire and Traumatic Brain Injury. Challenging risk types, US-exposed risks (on non-US placements), risks with adverse loss experience and programs with low deductibles or attachment points experienced a more challenging environment characterized by stringent underwriting, conservative capacity deployment and material price increases in some cases.

Despite increasing complexity and frequency of ransomware incidents and ongoing privacy-related losses, softening market conditions continued as growth-focused insurers expanded their appetite, and capacity across the market. Underwriting requirements eased slightly as insurer understanding of Cyber risk further matured while insureds presented stronger security controls. Concerns related to systemic and supply chain risk continued to mount. Focus on privacy controls continued, with specific attention on biometric data and pixel tracking, as well as new privacy/consumer protection regulations. Underwriters continued to evaluate and scrutinize coverage offered for critical infrastructure, systemic and/or correlated events, and war.

Softening conditions continued despite a complex backdrop of elevated risks including geopolitical instability, inflation, financial market fragility, equity market volatility, supply chain challenges, increasing litigation funding, and an evolving regulatory framework. Capacity from new and established insurers continued to increase in a growth-focused market with very few new buyers (IPOs, deSPACs, etc.), which created healthy competition and favorable client pricing outcomes. Underwriting remained disciplined, especially related to listed risks, cryptocurrencies, pharma and oil/coal related exposures, although underwriters demonstrated some flexibility in coverage terms and conditions for targeted risks. Alternative structures (e.g., higher retentions, coinsurance, quota shares, and alternative capital solutions such as captives) continued to serve as useful levers.

The market divergence between "targeted" and "non-targeted" risks continued. Risks in higher-hazard occupancy types, or that were Natural Catastrophe exposed or claims impacted, experienced conservative, challenging and volatile market conditions which were driven by increased reinsurance costs, increased Natural Catastrophe losses, inflation, and ongoing supply chain challenges. Well-performing risks and risks in lower-hazard occupancies experienced a more favorable environment characterized by increased line sizes and healthy competition; however, a focus on profitability continued. Across the portfolio, underwriting was disciplined, and scrutiny of insured values continued. Updated valuations and detailed descriptions of valuation methodologies were required. Margin clauses or coinsurance penalties were mandated where valuations were deemed inaccurate or under-reported. In response to the volatile geopolitical environment, underwriters further limited or excluded Strike, Riot and Civil Commotion (SRCC), Cyber, Terrorism, War and Sanctions, and implemented wider geographical exclusions.

Capability Overview

Casualty Risk Management and Insurance

Article

5 Top Trends for Risk Capital in 2025

Expand the options below to read a summary of regional insurance market trends in Q3 2023. For the full details, download the PDF.

Think strategically about insurance as a form of "rented capital" and consider it in your firm’s capital allocation strategy. Capital allocation is no longer limited to retirement planning and budgeting; business leaders’ approach to capital allocation has changed as theories have evolved and as tools of business have matured. In the modern business world, C-suite leaders understand that capital allocation – to distribute and invest financial resources to maximize stakeholder profits – is the core function of their job. Through this new, more strategic lens, firms can utilize insurance as a way to free up other sources of capital that can be deployed to drive growth and profit. Banks have been focused on capital optimization for a long time and now, with AI, the Internet of Things (IoT) and advances in technology that have enabled the robust identification and quantification of risk factors, the shift can happen more broadly.

Review policy language, limits, sub-limits and deductibles related to Cyber, Terrorism, War, Political Violence and Civil Unrest. Look closely at Sanctions Clauses and provisions related to physical loss or damage to property, business interruption and extra expense, as well as Ingress/Egress and Contingent Time Element (CTE). Insurers are implementing further limitations and exclusions – you may want to consider purchasing specific coverage for Political Risk, Special Risks, Cyber, War, Terrorism, SRCC, Travel, and Accident & Health. Talk to your Aon team about Alpha – Aon’s global facility for Terrorism and Political Violence coverage. Reach out to your Aon Team and to your insurer(s) if your covered location(s) or operation(s) have sustained damage or if you believe business interruption has occurred.

Underwriters are evaluating more information than ever. In addition, while escalations and referrals have decreased in some parts of the market, they remain common and often require longer lead times. Start the renewal process early to ensure you have sufficient time to tell your story and respond to queries, and to provide underwriters sufficient time to properly evaluate and price your risk.

Insurers are focused on risk quality, and risk differentiation is key to achieving superior outcomes. Leverage available data to provide robust, quality underwriting information including property valuation methodologies, risk modelling, risk improvements, lessons learned from past claims and actions you are taking to build resilience. Provide access to experts from across your organization. Step up in-person engagement where appropriate.

Inflation, rising labor costs and supply chain disruptions have driven up property and business interruption values while social inflation and changes in companies’ operations and geographic footprints have impacted liability risk. Work with your Aon team and across your organization to conduct a thorough assessment of your exposures and valuation methodologies and ensure that sums insured, indemnity periods, limits and deductibles are up-to-date and aligned. This will help guard against underinsurance and avoid insurer-imposed limitations such as margin and coinsurance clauses.

General Disclaimer

The information contained herein and the statements expressed are of a general nature and are not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Stay in the loop on today's most pressing cyber security matters.

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Explore Aon's latest environmental social and governance (ESG) insights.

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Explore our hand-picked insights for human resources professionals.

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

Article

Insurers continue to adapt and respond to the dynamic Property risk landscape by refining their appetite, coverage language, and underwriting practices.

Article

Generative Artificial Intelligence (AI) – a type of artificial intelligence that has the ability to create material such as images, music or text – is already a proven disruptor and its adoption is growing at an explosive rate.

Report

This quarter’s report describes some of the important developments in the Q3 insurance market and includes special features (on topics such as Generative AI and “Nuclear Verdicts”) to help you navigate the complexities and challenges of today’s risk and insurance environment.