Protecting North American Contractors from Extreme Heat Risks with Parametric

Growing extreme heat conditions have escalated risks, delays and costs for the construction industry in North America. Parametric insurance can help protect against such risks, offering contractors and building owners agility, efficiency and flexibility.

Key Takeaways

-

Extreme heat presents significant challenges to construction projects, leading to delays, increased costs and concerns about workforce health.

-

Parametric insurance serves as a valuable tool, offering flexible coverage triggered by independent events, quick claim settlements and strategic access to liquidity.

-

Advanced data, protecting workers’ health and partnering with qualified brokers are key considerations when exploring parametric insurance as a proactive heat risk management strategy.

Extreme heatwaves, fueled by climate change, represent one of the most pressing challenges for the construction industry in North America. The most devastating impact is on human health and life, with heat-related deaths surpassing those of any other weather-related danger. This is accompanied by significant indirect health issues, such as respiratory failure, cardiovascular disease and heat stroke.

From a business standpoint, extreme heat creates widespread issues, affecting operations, productivity and employee wellbeing. Particularly in the agriculture and construction industries, the impact of heat on labor productivity is significant, resulting in estimated annual losses of $100 billion in the U.S. alone.1

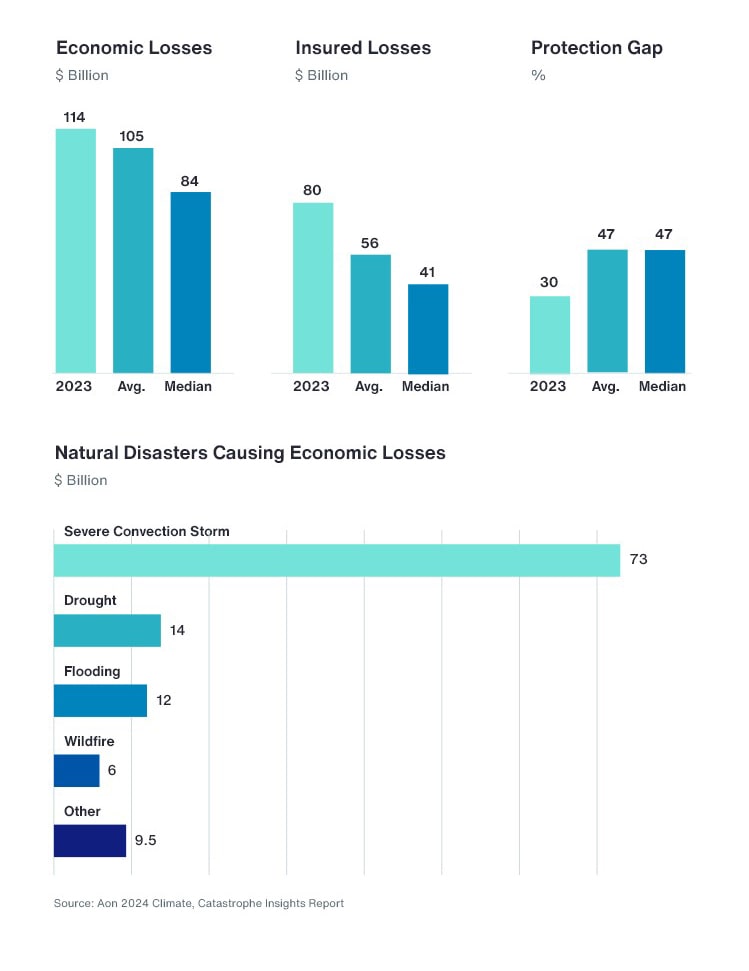

2023 Losses from Natural Disasters in the U.S.

Unlike acute perils, the full impact of chronic perils like extreme heat are often cumulative and difficult to measure, leaving a potential protection gap (see graphic). Further, while traditional insurance markets address physical damage, the economic implications faced by clients, including business interruption and loss of employee income, are often more substantial.

30%

U.S. losses as percentage of global economic losses

Source: 2024 Climate and Catastrophe Insights report

Extreme Weather Highlights: North America

- Phoenix, Arizona saw 31 consecutive days of 110 degrees Fahrenheit or greater temperatures in June-July 2023, breaking the heat record.

- Prolonged drought conditions in the Southwest led to $14 billion in economic losses and $6.5 billion in insured losses.

- The majority of outdoor fatalities, between 50 percent and 70 percent, occur in the first few days of working in warm or hot environments, according to OSHA. This is because the body needs to build a tolerance to the heat gradually over time — also known as heat acclimatization. A lack of acclimatization represents a major risk factor with fatal outcomes.

- Since 2011, the Bureau of Labor Statistics has reported 436 deaths due to workplace heat exposure and 2,700 cases of heat-related illnesses, leading to lost days at work.

- OSHA has intensified its enforcement of inspections where workers are exposed to heat hazards, especially in high-risk industries like construction and agriculture.

67%

U.S. losses as percentage of global insured losses

Source: 2024 Climate and Catastrophe Insights report

Amid increasing volatility and complexity, there is a significant opportunity for construction and real estate organizations to leverage parametric solutions to become more resilient to the climate and catastrophe risks.

How Parametric Solutions Can Help

Parametric insurance is complementary to traditional insurance solutions. It can be used in situations like extreme heat, where a risk must be mitigated and may not be covered via traditional markets.

Unlike traditional insurance, parametric coverage is triggered by predefined parameters, providing quicker and more transparent claim settlements. With its flexibility and broad scope, parametric insurance helps bridge the protection gap, making it an ideal alternative risk transfer solution in catastrophe-prone areas — and in areas where extreme heat is an issue.

Parametric takes an “if-then” approach. As more risk managers rethink their risk resilience, this method complements and supplements traditional insurance, paving the way for an innovative and transformative, yet straightforward solution, perfectly suited for catastrophic events.

Here’s how the core mechanics of parametric insurance work:

1. The “if:” Parametric insurance stands out due to its coverage trigger and pre-agreed payouts. Underwriting is simplified as coverage is activated by the occurrence of an independent event, as determined by neutral third-party data providers.

2. The “then:” With the independent data trigger and pre-agreed amounts, recoveries occur swiftly — often within days or weeks of an event. This quick access to capital is critical for businesses that need immediate financial assistance following an event.

3. Solving the protection gap: Parametric insurance offers broad coverage, ensuring that any economic exposure arising from an event can be insured. Previously uninsurable exposures become insurable, with the parametric trigger acting as the missing link to unlock flexible capital.

Case Study: How Parametric Helped Texas-based Contractor

-

Situation

Extreme heat is a growing concern in the southwestern U.S. – Texas recorded its second-hottest summer in history in 2023, and above-average temperatures are again forecasted for 2024.[1] A Texas-based general contractor saw many of its 2023 projects idled as a result. While the firm built in certain delays due to expected heat spells that could idle its labor force, it was also concerned about prolonged extreme heat scenarios that would increase delays and costs over its allotted budget. It looked at traditional insurance, but extreme heat exposure is not easily addressed in this market. The business therefore needed a more innovative solution to transfer the risk, especially with another hot summer quickly approaching.

-

Solution

The contracting firm’s broker recommended a parametric extreme heat cover that provided a payout if the number of days of extreme heat (clearly defined in the policy) exceeds a pre-agreed threshold. The payout would also provide flexibility to address any economic loss the contractor would incur resulting from the event. This would include overtime pay to reduce delays, increased financial support to workers and contract penalties associated with delays.

Parametric Benefits for Construction Stakeholders

| For Contractors | For Building Owners |

|---|---|

| Reduces contingencies in contract prices | Mitigates income loss from delays to commercial operations dates |

| Enables worker wellbeing | Enables worker wellbeing |

| Facilitates access to capital — Parametric may cover additional costs to help keep projects on schedule | Facilitates access to capital — Parametric may cover additional costs to help keep projects on schedule |

| Includes possible liquidated damages for delays and associated expenses | Ensures debt service is met in case of Cost of Delay (CoD) delay |

3 Ways to Take Action

The escalating risks posed by extreme heat in the construction industry demand proactive and innovative risk management strategies. To adapt and thrive through these heat-related challenges, it's crucial for construction companies to act now:

-

1. Use forward-looking data and analytics.

This includes weather data and heat tracking tools to understand the projected impacts of extreme heat on the business and its employees. By gaining insights into future risks, including temperature trends, heat indices, humidity levels and other environmental factors, firms can proactively implement preventive measures to safeguard operations and ensure the wellbeing of their workforce.

-

2. Prioritize workforce health and wellbeing.

Implement measures to reduce heat-related health risks. Create a heat illness prevention plan that plans ahead to protect workers, and encourages water, rest and shade.

-

3. Collaborate with experienced brokers and explore alternative solutions.

Ensure brokers specialize in mitigating risks in the construction industry and consider alternative solutions like parametric insurance. By partnering with knowledgeable professionals, companies can tailor their risk management strategies to their specific needs, enhancing resilience to extreme heat events.

70%

Percentage of losses covered by insurance

Source: 2024 Climate and Catastrophe Insights report

General Disclaimer

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Aon's Better Being Podcast

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Aon Insights Series UK

Expert Views on Today's Risk Capital and Human Capital Issues

Construction and Infrastructure

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Cyber Labs

Stay in the loop on today's most pressing cyber security matters.

Cyber Resilience

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Employee Wellbeing

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Environmental, Social and Governance Insights

Explore Aon's latest environmental social and governance (ESG) insights.

Q4 2023 Global Insurance Market Insights

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

Regional Results

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Human Capital Analytics

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Insights for HR

Explore our hand-picked insights for human resources professionals.

Workforce

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Mergers and Acquisitions

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

Navigating Volatility

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Parametric Insurance

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Pay Transparency and Equity

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Property Risk Management

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Technology

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Top 10 Global Risks

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

Trade

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

Weather

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Workforce Resilience

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

More Like This

-

Article 6 mins

DC Pension Schemes: Improving Investment Returns

With DC schemes growing across Europe, many organizations are realizing the importance of ensuring strong performance from their investments. Here’s how asset owners and managers can optimize DC outcomes through the right investment strategy.

-

Article 9 mins

Developing a Paid Leave Strategy That Supports Workers and Their Families

With no federal paid leave law in the U.S., employers have limited guidance in designing equitable and comprehensive paid leave programs to support their workforce. Looking beyond compliance to focus on strategy and values will help create fair and well-designed policies.

-

Article 6 mins

Leading the Biofuels Transition: Risk Strategies to Cut Through Complexity

Companies aiming to be a net-zero company may face many challenges during the biofuels transition. Read more on risk strategies to cut through complexity.