Public company D&O insurance can differ significantly in structure from private company D&O insurance. One key distinction is the separation of limits; in public company policies, D&O coverage generally is no longer tied to other management liability coverages, such as employment practices and fiduciary. This separation allows for more tailored protection.

Public companies often incorporate dedicated Side A difference in conditions (DIC) insurance, designed to protect individual directors and officers when the company cannot indemnify them. Including dedicated Side A/DIC limits within the D&O insurance tower is another crucial structural consideration for companies transitioning to public status.

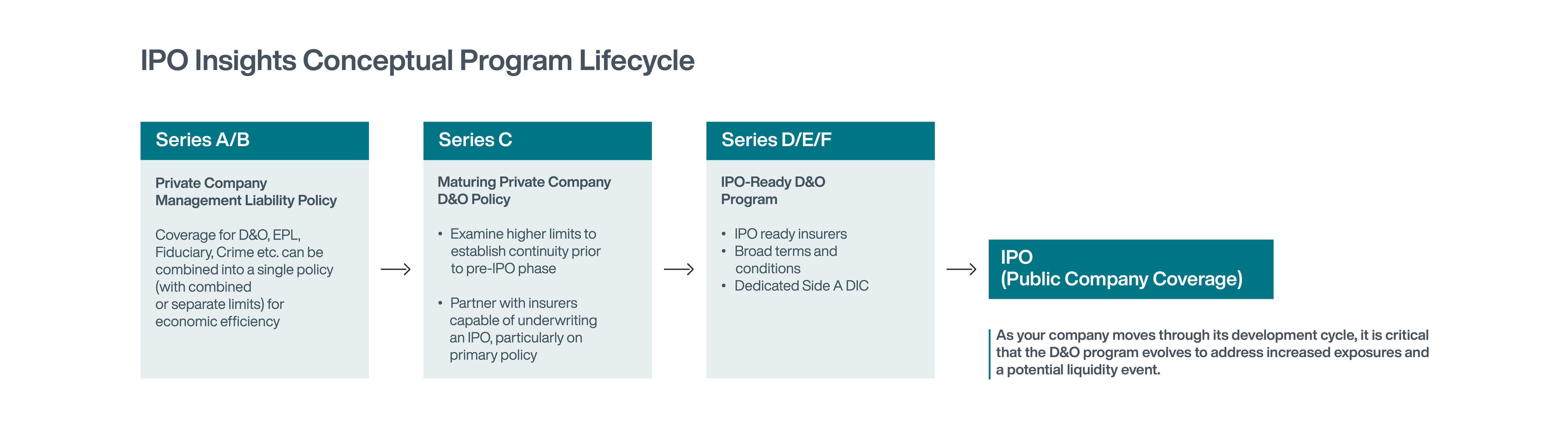

Businesses should also evaluate whether to run off prior coverage, which has its pros and cons and requires fact-dependent analysis. IPO candidates must select a program structure that aligns with their unique risk factors and corporate philosophy.

Moreover, as companies go public, it is important to adopt a significant mindset shift. Management and board members should embrace increased and often required transparency in their decision-making processes, particularly regarding executive pay, board governance and talent evaluation. Laura Wanlass, partner and ESG practice leader of executive rewards and board advisory services at Aon, emphasizes this change. “There’s just this general shift in mindset that has to occur from private to public, where management, even the board, has to think about the increased amount of transparency in decisions that didn't have much transparency when they were private.”

This heightened scrutiny necessitates a robust public company D&O program to protect against a range of potential liabilities, serving not only as a safeguard, but also as a compelling recruitment tool for new board members. Wanlass further highlights that “when you go public, the key committees of a board must start evaluating whether the team that was successful in the private domain is successful in taking you into the public domain. So, there's the risk associated with disclosure, but really, there's this whole need to additionally reevaluate talent as part of this.”