4 Megatrends Affecting Middle Market Organizations in North America

Trade, technology, weather and the workforce are interconnected trends shaping the future of business in North America. Understanding them is key to long-term resilience.

Key Takeaways

-

Businesses in North America must navigate a volatile landscape influenced by trade, technology, climate risks and workforce challenges.

-

Understanding the local impact of global trends is essential for an effective risk management strategy.

-

Businesses should use data analytics to withstand these megatrends and enhance operational efficiency.

As the global business environment rapidly evolves, organizations across North America face a series of complex challenges. Aon’s 2024 Client Trends Report identifies four interconnected megatrends that continue to shape business operations and strategies: trade, technology, weather and the workforce.

Each trend presents a unique set of risks, from supply chain disruptions and cyber security threats to regulatory changes and the challenge of talent retention. However, these risks also present opportunities for growth, innovation and improved risk management. Midsize businesses are under increasing pressure to adapt as they balance more limited resources with the need to remain competitive and resilient.

1. Trade: Understanding Business Interruption Exposure

The global trade landscape is complex and increasingly unpredictable, presenting a series of interrelated challenges for businesses. Geopolitical instability, inflation, climate change, currency fluctuations and workforce shortages necessitate a strategic and asset-conscious approach to mitigate risk.

These methods often involve careful resource allocation and balancing reactive and proactive strategies. Key decisions include ensuring core elements are in place, such as appropriate insurance cover, and determining how best to manage growth, workforce development and supply chain stability.

While the issues are global, how they affect individual businesses is local, and the most suitable solutions will vary depending on resources, goals and priorities.

All of the top 10 risks identified by North American business leaders in Aon’s latest Global Risk Management Survey have implications for trade, with four directly linked:

- Economic slowdown/slow recovery

- Supply chain or distribution failure

- Business interruption

- Damage to reputation/brand

Economic slowdowns and supply chain disruptions are key drivers of business interruption (BI), leading to lost revenue and decreased productivity. To mitigate these risks, companies must assess their supply chain strategies, focusing on potential vulnerabilities like political instability, regulatory changes and disruption from natural disasters.

Organizations should consider their supplier location strategy to determine any weaknesses. Tailored strategies that consider business size and available resources can then be developed to address weaknesses, such as investing in local sourcing or building redundancies into the system to ensure business continuity.

Businesses should also not underestimate the complexity, time and cost of returning to normal operations after an interruption. To address this exposure, it’s important to develop detailed contingency plans that account for both internal and external threats. Critical to this preparation is understanding BI exposure and setting appropriate limits of indemnity. These limits ensure coverage is sufficient for the potential financial losses that occur during the recovery period. By proactively addressing BI exposure, businesses can better safeguard against prolonged interruptions and avoid gaps in coverage that could hinder recovery.

Operating costs remain a significant pressure across industries, particularly for midsize businesses impacted by ever-thinning margins. Companies should consider evaluating their legacy partnerships and investments to ensure they are still delivering value.

2. Technology: Balancing Risk and Opportunity

New and growing technologies present significant opportunities to businesses. AI, which has dominated headlines over recent months, can streamline processes and generate valuable data insights. Cloud computing offers accessible and cost-effective storage for businesses of all sizes, while quantum technology can enhance data security. However, while these technologies may be revolutionary, they also present new and evolving risks to businesses. Leaders must balance the practical applications and benefits they offer the workforce with the inherent dangers to determine their place in any business framework.

As technological dependence grows, cyber attacks remain a constant threat, testing organizations’ cyber resilience. Rapid adoption of emerging technologies, particularly when there is a knowledge gap, increases exposure to new risks that may not be fully understood, thereby weakening overall resilience. Businesses, particularly those with more limited budgets and resources, should prioritize comprehensive training to ensure employees are equipped to handle these risks, as human error remains a critical vulnerability in cyber security.

By 2025, more than half of cyber events are expected to be caused by human factors, making fostering a culture of cyber security awareness essential. Employees must feel empowered to report suspicious activities without fear of retribution, while ongoing training is necessary to ensure they are able to recognize threats, such as phishing attacks, when they occur. Creating this culture requires leadership to set the tone by prioritizing cyber security.

A key aspect of this is maintaining robust access controls, only providing employees with access to the data needed for their roles. This reduces the risk of insider threats and accidental breaches. Continuous evaluation of policies, regular assessments of human-related risks, and updating and maintaining training protocols will help businesses stay ahead of evolving threats.

$9.4M

Average cost of a data breach in the U.S. in 2024 ($9.5 million in 2023)

Source: Cost of a data breach 2024 | IBM

Once these fundamental elements are addressed, if budgets allow, data analysis and modeling can be used to assess cyber risks, informing decisions about appropriate insurance coverage. Cyber insurance can be tailored to suit both budget and exposure, covering threats like data breaches, ransomware attacks and other cyber incidents. For organizations that may not have sufficient resources to independently recover from a significant cyber incident, the right insurance coverage is particularly crucial.

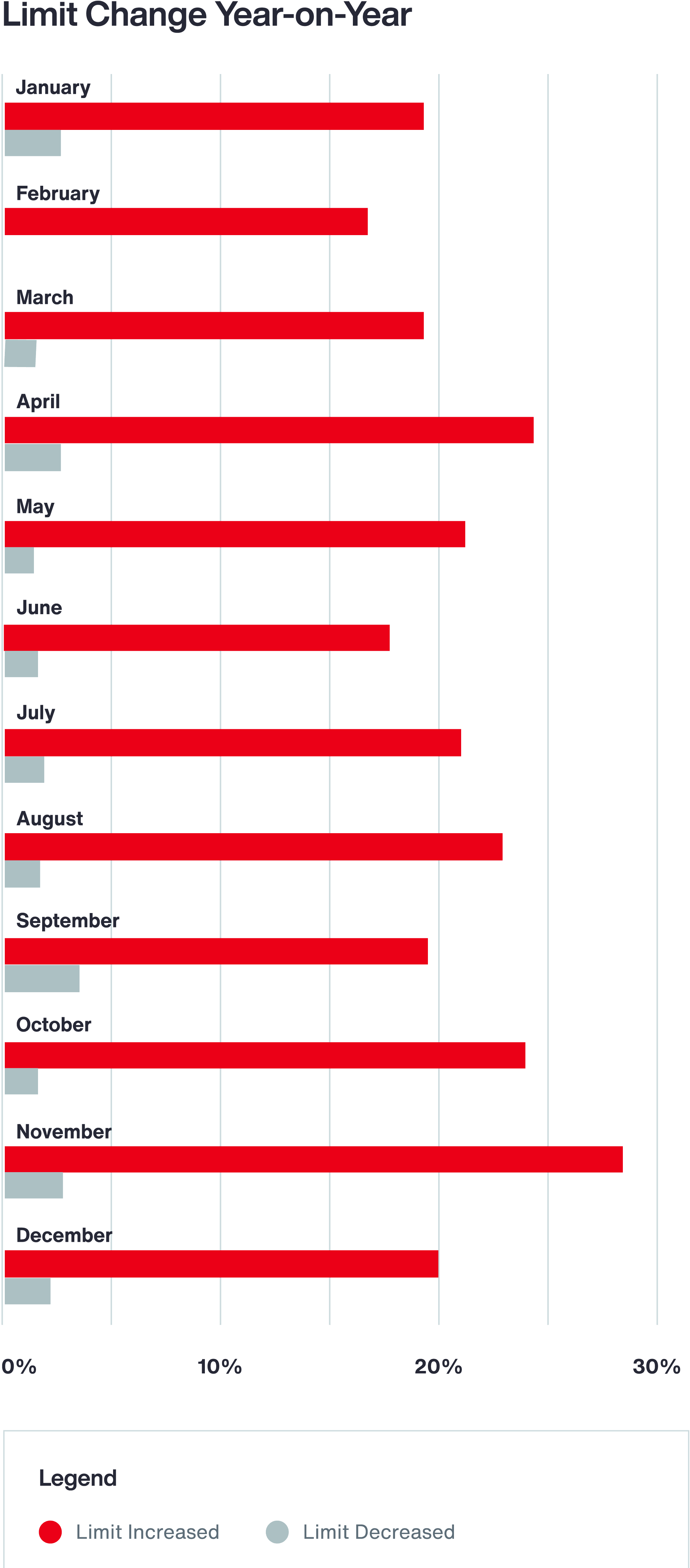

Trends in the insurance market from 2023-2024 show that U.S. businesses are purchasing increased cyber limits to provide coverage against growing instances of cyber attacks and rising levels of exposure. In the last quarter of 2023, roughly 20-25 percent of businesses purchased additional limits while less than 3 percent purchased less limits.1

$4.7M

Average cost of a data breach in Canada ($5.1 million in 2023)

Source: Cost of a data breach 2024 | IBM

U.S. Businesses are Buying Increased Cyber Limits

3. Weather: Customizing Mitigation Strategies

The increasing frequency of extreme weather events in North America, from wildfires and hurricanes to floods, demands a proactive and reactive response from businesses and organizations. These climate-related events can cause severe disruption to supply chains and business operations, in addition to endangering the safety of employees.

While climate change is a global issue, its impacts are highly localized, which should be reflected in the strategies organizations adopt to counter the risks it presents. For example, investing in infrastructure improvements in the face of extreme weather threats is vital, but where to direct this investment will vary regionally. Flood-proofing buildings may be a priority, or upgrading HVAC systems to ensure they remain operational during extreme heatwaves. Creating detailed disaster recovery plans that include clear communication and back-up plans for displaced workers or disrupted supply chains is crucial.

5.4K

Number of wildfires in Canada in 2024

Source: Canadian Wildland Fire Information System | National Wildland Fire Situation Report (nrcan.gc.ca)

Engaging in community preparedness initiatives is also a vital part of strengthening resilience. By collaborating with local governments, community organizations and other businesses, organizations can benefit from pooled resources for faster recovery during extreme weather events.

Businesses must also stay informed of evolving regulatory landscapes at a state/province and national level. How regulatory changes apply will vary from industry to industry. In Canada, the 2030 Emissions Reduction Plan,2 which is part of a governmental commitment to reach net zero by 2050, proposes a number of new regulations with a cross-industry impact, such as the reduction of methane emissions from municipal solid waste landfills by 2030. In the U.S., the Clean Diesel Program3 from the EPA — also designed to reduce emissions — targets the trucking industry, mandating stricter standards for trucks from the 2027 model year.

Organizations may have some flexibility when it comes to mitigation strategies — including their timing and implementation — but adhering to regulatory changes is mandatory, with often strict consequences for non-compliance.

Midsize businesses should adopt a proactive approach to the pressing threat of climate change and customize mitigation strategies by location, industry and available resources. They can then further reduce the protection gap, respond to regulatory changes and unlock new sources of risk capital.

44.6K

Number of wildfires in the United States in 2024

Source: National Fire News | National Interagency Fire Center (nifc.gov)

4. Workforce: Using Culture as a Differentiator

Current challenges for HR leaders and professionals are trending toward managing total rewards expenditure, complying with pay transparency regulations and reskilling employees for AI integration. How businesses address these issues will significantly impact their ability to attract and retain talent — which has become the fourth highest global risk for the first time in 2024.4

Employees across all industries, irrespective of the size of the organization, expect and often rely upon a competitive rewards package. Benefits such as healthcare, flexible working arrangements and mental health support are essential. Additionally, a demonstrable commitment to reskilling and upskilling the workforce to mitigate the risks of AI displacement will be critical.

Midsize organizations can differentiate themselves from larger firms by offering a combination of focused, attractive benefits and a supportive work environment that emphasizes company culture, a team-oriented approach, and a sense of community and belonging among employees.

One strategy may be to offer unique perks that align with the company’s values and culture, focusing on elements such as flexible working arrangements, professional development opportunities and focused wellness programs. Taking a creative approach — offering student loan assistance, caregiver support, time off or mental health resources, for example — can help midsize firms compete against larger companies. Demonstrating these priorities during the recruitment process may win talent, but maintaining a long-term commitment to employee wellbeing is the key to retention.

Pay transparency is another pressing issue, with new regulations in place in more than 20 U.S. states and six Canadian provinces. Companies need to identify any existing pay gaps and ensure equitable compensation structures. If budget allows, pay equity consulting — including a pay equity audit to identify gaps, a robust job architecture for roles, remediation strategies and a focus on financial wellbeing — can help to create greater pay equity within the workplace. This not only promotes a culture of trust and transparency, which has a positive impact on employee wellbeing, but also offers an additional way for midsize organizations to distinguish themselves from competitors.

Data and Analytics are Key to Tackling All 4 Trends

Navigating the complexities of trade, technology, weather and workforce dynamics is a complex task for businesses of all sizes, requiring a proactive and informed approach. Leaders need to understand their organization’s specific risk exposure, how their insurance program will respond in the event of a loss and how to maximize available budget and resources to address any gaps. Throughout this process, harnessing data and analytics can lead to better decision making and enhanced operational efficiency.

-

1. Informed Decision Making

Data-driven insights enable firms to make informed decisions about supply chain management, resource allocation and risk mitigation strategies.

-

2. Predictive Analytics

By analyzing historical data, companies can forecast potential disruptions related to trade policies, weather events or technological changes, allowing them to proactively adjust operations.

-

3. Risk Assessment

Data analytics help firms assess and quantify risks, providing a clearer understanding of potential impacts on their business and enabling them to prioritize their risk management efforts.

-

4. Operational Efficiency

Using data can streamline operations, optimize inventory levels and enhance workforce management, which is particularly important in a competitive environment with limited resources.

-

5. Enhanced Resilience

Analytics can identify vulnerabilities within the organization, helping firms develop contingency plans and improve their resilience against unexpected events.

-

6. Talent Management

Data-driven insights into workforce trends allow firms to better attract, retain and manage talent, ensuring they have the right skills in place to navigate challenges.

General Disclaimer

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Aon's Better Being Podcast

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Aon Insights Series Asia

Expert Views on Today's Risk Capital and Human Capital Issues

Aon Insights Series Pacific

Expert Views on Today's Risk Capital and Human Capital Issues

Aon Insights Series UK

Expert Views on Today's Risk Capital and Human Capital Issues

Construction and Infrastructure

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Cyber Labs

Stay in the loop on today's most pressing cyber security matters.

Cyber Resilience

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Employee Wellbeing

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Environmental, Social and Governance Insights

Explore Aon's latest environmental social and governance (ESG) insights.

Q4 2023 Global Insurance Market Insights

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

Regional Results

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Human Capital Analytics

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Insights for HR

Explore our hand-picked insights for human resources professionals.

Workforce

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Mergers and Acquisitions

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

Navigating Volatility

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Parametric Insurance

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Pay Transparency and Equity

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Property Risk Management

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Technology

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Top 10 Global Risks

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

Trade

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

Weather

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Workforce Resilience

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

More Like This

-

Article 7 mins

Why Organizations Need a Robust Directors and Officers Risk Program

A variety of growing risks, including shareholder derivative actions, an evolving regulatory environment and bankruptcy filings, are why public and private organizations must protect their corporate directors and officers.

-

Article 15 mins

Navigating Cyber Risks in EMEA: Key Insights for 2025

Organizations in EMEA face unprecedented challenges as cyber threats become more sophisticated. In the face of emerging AI, evolving regulations and geopolitical tensions, businesses should strengthen their resilience to better navigate the complexities of the digital age.

-

Article 6 mins

Outsourced Chief Investment Officer: The Key to Navigating Volatility

In a volatile climate, institutional investors are turning to outsourced chief investment officers to conquer administrative, regulatory and market challenges.